E-File Form 2290 for Quick Processing

Get stamped schedule 1 in minutes

- Quick Processing

- Free VIN Corrections

- Guaranteed Schedule 1 or your Money Back

File Your 2290 Now

File Your Form 2290 for just $14.90

E-filing with Form2290.net is the fastest, most secure, and error-free way to complete your Form 2290 with no manual tax calculations needed.

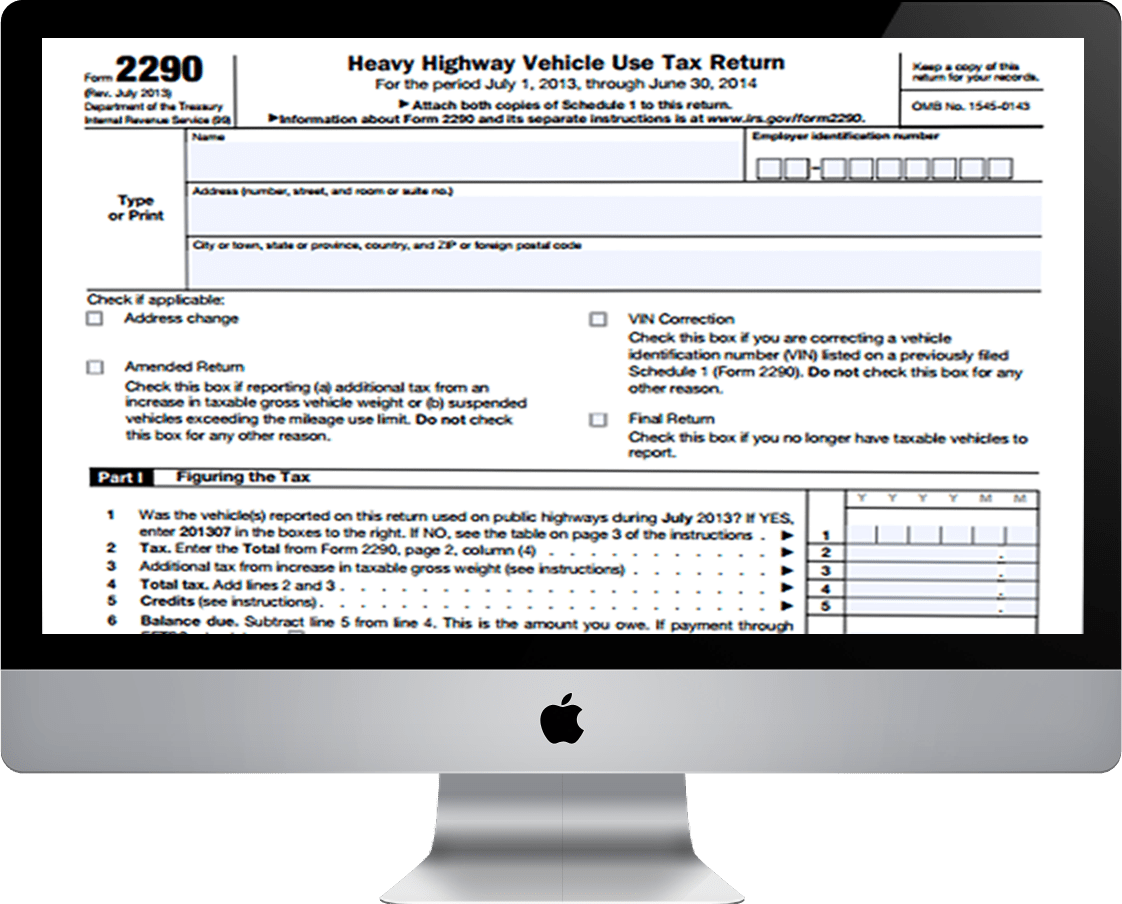

About Form 2290

You are required to file a Form 2290 in order to report your truck taxes. Every year in July, the Form 2290 reporting period starts over again, with a August 31 deadline to File Form 2290 online. However, the deadline varies based off of the first used month for your vehicle. Also, you can e-file Form 2290 in June if you would like to pre-file. After you file your Form 2290, you will receive your updated Stamped Schedule 1, showing the number of trucks you reported to the IRS. This form serves as proof that you paid for and completed IRS Form 2290, and is accepted by the USDOT and DMVS. You need to file IRS Form 2290 by the last day of the month following the vehicle’s first used month. For example, if you first use your vehicle in January, you will need to e-file Form 2290 by the end of February. Remember, you must file Form 2290 annually to renew your Schedule 1.

E-File Form 2290 NowAttributes of Form 2290

Guaranteed Schedule 1 or Money Back

Make Free VIN Correction

Transmit Rejected Return for Free

Instantly get Your 2290 Stamped Schedule 1

Make Free VIN Corrections

Automatic Error

Check

Information Needed to file Form 2290

For Filing Form 2290, you need information like

- Business Name, Address and Employer Identification Number (EIN).

- Vehicle Identification Number (VIN), Taxable Gross Weight, First Use Month (FUM) and Suspended Vehicle Information (If any).

Visit https://www.expresstrucktax.com/efile/irs2290/ to Know more about IRS Form 2290 filing Instruction.

Steps to E-File Form 2290